import rate into china for rolex watch | tax on personal watches import rate into china for rolex watch China’s Finance Ministry has created three tax categories when it comes to just the import tariff which are 15%, 30%, and 60%. Luxury watches (along with many other luxury goods) fall in to Category 3 which has a 60% import tariff applied to it. See Price In Cart. $159.99 *. adidas Men's Adizero Adios Pro 3 Running Shoes. $249.99. adidas Men's SL20 Running Shoes. $109.99. Shop Men's adidas Running shoes at .

0 · tax on personal watches

1 · swiss watch import duty

2 · do customs pay watches

3 · customs duty on watches

4 · are watches taxable in usa

5 · Rolex overseas purchases

6 · Rolex import duty

$139.99

China’s Finance Ministry has created three tax categories when it comes to just the import tariff which are 15%, 30%, and 60%. Luxury watches (along with many other luxury goods) fall in to Category 3 which has a 60% import tariff applied to it. Not worth getting caught with an extra non-declared watch. In general, just buy it .Calculate import duty and taxes for hundreds of destinations worldwide with this web-based .

China’s Finance Ministry has created three tax categories when it comes to just the import tariff which are 15%, 30%, and 60%. Luxury watches (along with many other luxury goods) fall in to Category 3 which has a 60% import tariff applied to it. Not worth getting caught with an extra non-declared watch. In general, just buy it and declare it. The only thing extra in addition to your state tax is likely the federal tax/duties on import which could range in percentage but certainly not that high.Calculate import duty and taxes for hundreds of destinations worldwide with this web-based tool. Enter product details, shipping and insurance costs, and get free calculations up to 5 times per . Learn how to declare and pay duties and taxes on your personal watches when traveling to watch-producing countries like Switzerland, Germany, Japan, and the U.S. Find out which brands each country produces and how to avoid the worst penalties and fines.

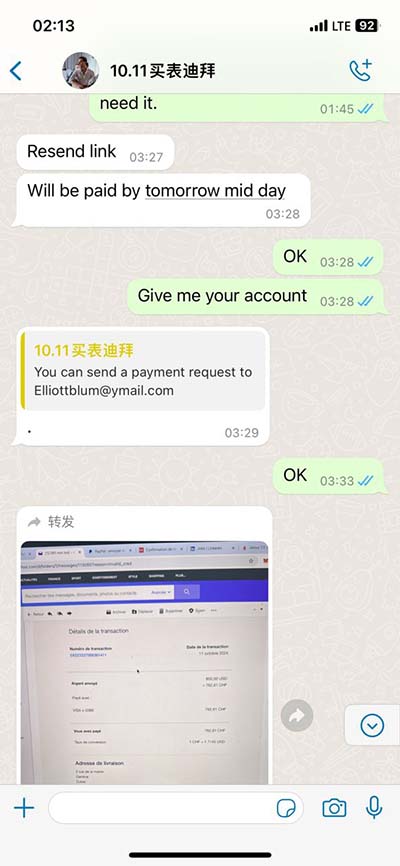

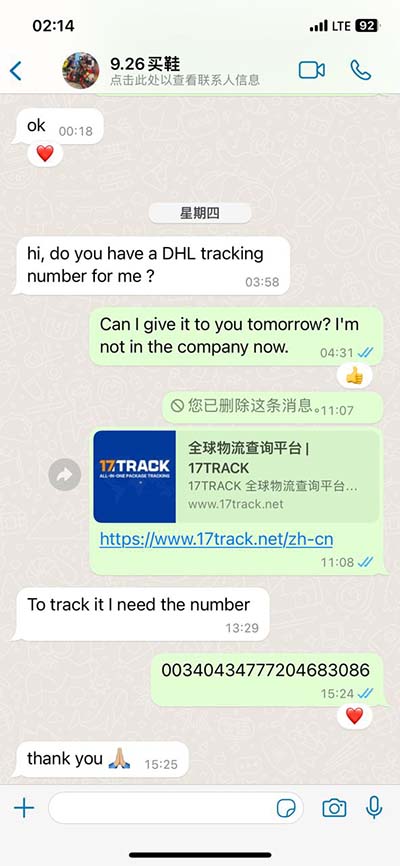

With a watch, the import duty is broken down into 3 parts, each at a vastly different rate: movement, case, strap/bracelet. If the seller specifies the value for each (typical if you're buying from the manufacture) you must just pay what they valued everything at.If you declare your watch at US customs, you may (will?) receive a use tax bill from the state of California. Like the OP, I declared a watch purchase made abroad (a Grand Seiko purchased in Taiwan from an AD).The rates can vary based on factors such as the type of watch, its materials and the country of origin. Since January 2022 custom rate revisions, the basic customs duty is around 20% of the assessable value, which includes the cost of the watch, insurance and freight charges. Chinese customs charge 20% duty for watches under 00 and 50% for watches over 00, but whether you’ll get the bill is a matter of chance. I think as a buyer s/he is supposed to understand these things and they are outside the responsibility of the seller.

I'll be purchasing a luxury watch while in Europe and bringing it back from Europe to the United States. The total cost will exceed K. I've read about the need to provide my passport at time of purchase to avoid the VAT. I plan to bring the watch back in it's original pouch through my carry on. Hong Kong and mainland China were the top two markets for Swiss watches, with sales in Hong Kong rising 21.3 percent to 15 percent of the market and mainland China sales skyrocketing by 44.3 percent to reach 10.9 percent of the market. To understand the luxury watch market in China, we analyze Rolex in China.

China’s Finance Ministry has created three tax categories when it comes to just the import tariff which are 15%, 30%, and 60%. Luxury watches (along with many other luxury goods) fall in to Category 3 which has a 60% import tariff applied to it. Not worth getting caught with an extra non-declared watch. In general, just buy it and declare it. The only thing extra in addition to your state tax is likely the federal tax/duties on import which could range in percentage but certainly not that high.Calculate import duty and taxes for hundreds of destinations worldwide with this web-based tool. Enter product details, shipping and insurance costs, and get free calculations up to 5 times per .

Learn how to declare and pay duties and taxes on your personal watches when traveling to watch-producing countries like Switzerland, Germany, Japan, and the U.S. Find out which brands each country produces and how to avoid the worst penalties and fines. With a watch, the import duty is broken down into 3 parts, each at a vastly different rate: movement, case, strap/bracelet. If the seller specifies the value for each (typical if you're buying from the manufacture) you must just pay what they valued everything at.If you declare your watch at US customs, you may (will?) receive a use tax bill from the state of California. Like the OP, I declared a watch purchase made abroad (a Grand Seiko purchased in Taiwan from an AD).

The rates can vary based on factors such as the type of watch, its materials and the country of origin. Since January 2022 custom rate revisions, the basic customs duty is around 20% of the assessable value, which includes the cost of the watch, insurance and freight charges.

Chinese customs charge 20% duty for watches under 00 and 50% for watches over 00, but whether you’ll get the bill is a matter of chance. I think as a buyer s/he is supposed to understand these things and they are outside the responsibility of the seller. I'll be purchasing a luxury watch while in Europe and bringing it back from Europe to the United States. The total cost will exceed K. I've read about the need to provide my passport at time of purchase to avoid the VAT. I plan to bring the watch back in it's original pouch through my carry on.

perfume chloe preço brasil

tax on personal watches

swiss watch import duty

List: $65.00. FREE delivery Tue, Jun 4. +10. adidas. Men's Adizero Cleats. 525. $6669. Typical: $69.95. FREE delivery Tue, Jun 4. Prime Try Before You Buy. adidas. F50 adizero Jr Youth Soccer Cleats Size 4.Suit up in the unmistakable style and vintage flair of adidas Firebird clothes. Shop adidas Firebird track apparel. Browse a variety of colors, styles, or customize your own online .

import rate into china for rolex watch|tax on personal watches